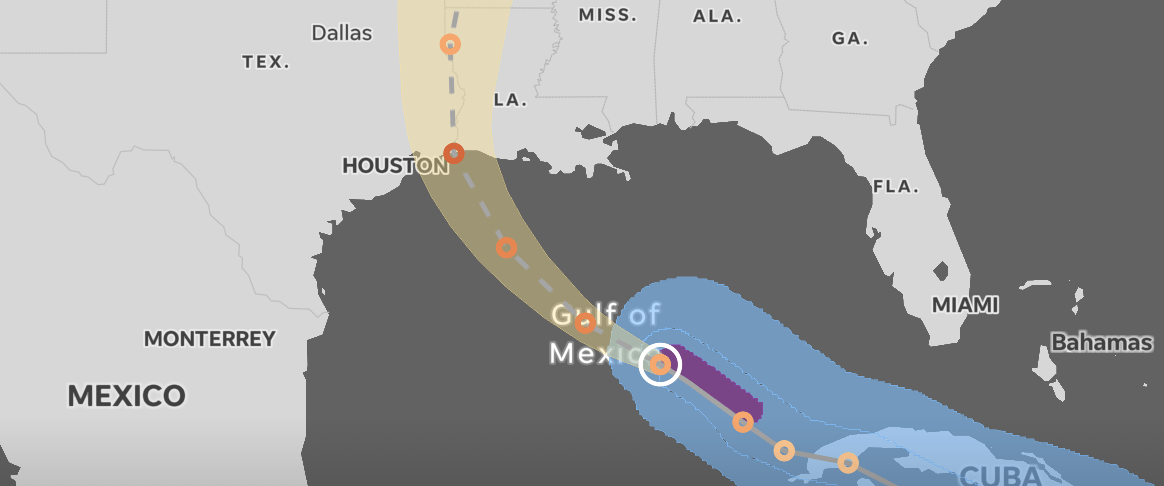

Hurricane Season

Jeff Esper

Preparing for Insurance Recovery

When catastrophe is looming, Risk Managers have a lot to contend with starting with protecting their people and their properties, but their worries don’t end there. Here are a few tips from the partners of RWH Myers for before and after a named storm visits one of your locations.

Pre-Loss

- Vet your emergency response team prior to loss

- Preparation is the key in any endeavor but with property damage claims, you cannot be too prepared. There are “approved” vendors that insurance companies recommend; however, just because they are “approved” does not mean there will not be problems. We deal with this frequently. Notify the insurance company of who you plan to use and make sure you discuss expectations with your vendors to limit surprises.

- Choose your adjustment team - When there are opposing sides with opposing interests, the outcome will be dependent on the experience and skills of the players on your team. Carefully select the independent adjusting firm and auditors. Work with your broker to find the right partner to be named in your policy. These relationships are critical to the claims process and outcome.

- Choose your claim team

- Having your team lined up and ready for action will help get any claim started quickly and properly. Your internal team may consist of risk management, finance and operations. It’s helpful to arrange your key sources of information that you’ll need to support your claim. Get to know your broker’s property claim experts. They will be instrumental in helping with policy interpretation and guidance throughout. Having an independent forensic accounting firm arranged ahead of time will ensure your claim preparation can begin immediately post loss. These experienced professionals will be a critical part of your claim team delivering the expertise to quantify the loss and pull all aspects of the claim together.

- Review Percentage Deductibles - When you are faced with a Hurricane CAT claim, whether from a recent weather event or in the future, figuring out how your percentage deductible applies may be more challenging than you expect. We suggest reviewing how it works with your broker and/or with your forensic accountants to make sure you understand how it will apply in a real-world scenario.

- Clarify and document scope of work - Be clear on scope of work with your emergency response and restoration company. Make the adjuster part of that conversation. Often, emergency response does not follow the normal protocols of a typical project. There likely won’t be time for detailed estimates, so try to get the adjuster to approve the work in real-time to avoid second guessing.

- Take a hands-on approach - Your property may still be underwater, but once access is granted, you must be hands-on. No one should have access to your facility without the presence of a company representative. It is vital to have a company representative onsite to manage the activity and guide visitors.

- Audit contractor charges before approving - The first weeks after a loss is chaotic. It’s important for policyholders to put controls in place to monitor activity and to verify work has been completed to specifications and according to the terms of the agreement. Reimbursable insurance expenses should be separated and audited prior to payment for proper detail and accuracy. This should be done efficiently in real-time and be sure to involve the adjuster throughout.

- Address issues immediately - When the first emergency response invoice arrives, insurance companies may act surprised and even dispute the expense, especially if the steps above have not been followed. Make sure to get the parties together to discuss the issues. Don’t procrastinate and don’t assume. It is important to be proactive with any potential discrepancies.

The immediate aftermath of a disaster can be stressful and hectic. Preparation and communication can help you weather the storm and minimize unwanted surprises and maximize recovery.

Insights Worth Sharing

Making a business interruption claim is more than just an accounting exercise. It requires a good strategy, a thoughtful process and perhaps most of all, patience. These lessons come from experience and the team at RWH Myers has earned it from decades of preparing BI claims. Though this topic is of the philosophical nature, it is just as important as the details behind a business interruption calculation. So let’s dive in and see what you really need to make a BI claim. Strategy Every loss is different. You can’t apply the same game plan and the same approach to every claim. You have to assess the situation and all its parts to devise a specific workable strategy. Experience will help ensure your strategy is appropriate for the situation, but the claim will take on a life of its own. The initial loss assessment is derived from the loss information such as what happened, the timeline of events, the impact to operations and how long it will take to get back to normal. As forensic accountants, we will look at the entirety of the situation and dissect it from every angle to figure out the full scope of loss and then determine the best approach to measuring and supporting the claim. We will also anticipate how the claim will be adjusted and plan for arguments against the claim. Taking the time to develop a proper strategy will pay off at every stage of the claim process. Process Once you understand the situation and have designed an effective strategy, you can lay out a process to get to the desired result. The process starts off with identifying and assembling the team to execute the plan. The claim will require data from various sources and input from key internal experts to provide insights as to the impact on operations, both upstream and downstream. The process also includes managing claim adjustment, from setting the timeline to handling requests for information. During the process, your claim preparer will work to keep all phases of the claim moving forward whether with data gathering or insurer feedback. Claims tend to start out with a high level of attention, but it is common to lose momentum. Simply put, a well-defined process will keep the claim moving, limiting distractions and roadblocks. Patience Patience doesn’t equate to conceding to a lengthy and arduous process. It’s just the opposite. By definition, it means, “quietly and steadily persevering or being diligent, especially in detail or exactness.” It is important to understand that certain parts of the claim take time to develop, and that time is critical to ensuring a thorough and well thought out claim presentation. For example, taking your time in the beginning of the process to lay out the foundational elements of the claim will avoid obstacles that may delay claim settlement and the amount recovered. It’s best to set expectations early and commit to the process. Again, practicing patience will expedite the claim process and improve the outcome. You can rely on the experience of your forensic accounting team to lead that effort. So, you see, it’s not all about the numbers. There is more to the intangibles than you may have thought. Every claim has its own unique challenges. You should be prepared for anything and everything. Again, preparing a claim is just as much strategy, process, and patience as it is the technical elements of claim preparation.

Property damage insurance claims are among the most infrequent for corporate policyholders, but this year Louisiana has suffered through a record number of Hurricanes. When catastrophe strikes, recovering insured losses essential to rebuild and resume operations. Effected policyholders will need expert help to evaluate, organize and document their claim to present to insurers. Forensic accountants that devote their practice to preparing claims for policyholders have every day experience just as adjusters and auditors do, so it is certainly to your advantage to hire a firm of experts to represent your interests throughout the property damage and time element claim process. Though the specific insurance claims and the policyholders may change, the vital steps to recovery remain the same. One thing both sides agree on is that the claim process goes smoother when the policyholder is well prepared for demands of a claim from start to finish. The partners at RWH Myers prepared a detailed guide to assist policyholders in preparation for claim recovery. It is designed to serve as a resource and a framework for the claim process and includes the following sections: Establish Appropriate Accounting Methodology: Provides guidance and an organizational framework for post-loss activities, establishing specific accounts to capture the loss. Property Damage Expense Categories: Explains the types of expenses that may be included in each category of coverage and the documentation required for these costs. Claim Preparation Objectives and Overview: Identifies objectives for the claim preparation process, and provides a conceptual framework for achieving them. What is Covered: Examines the direct and indirect exposures to loss that are typically encountered, and provides guidelines for determining whether specific types of property damage losses are covered under the policy. Claim Preparation Procedures: Suggests timetables for the submission of inventory, property damage, and discusses the format and content of standard claim submissions. Audit and Settlement Guidelines: Discusses the procedures undertaken by the insurers adjusters and experts, and provides an overview of the settlement process. Click here to download the full guide.